We’re here to help

Call 800-525-9094 for 24/7/365 live support

Chat is available for non-account related questions

Always here when you need us

Other office locations

Member Service Center

Open 24 hours a day, 7 days a week, 365 days a year

Call: 800-525-9094

International calls: +800-30804080

Routing number: 325272021

Email: GlobalCUMSC@globalcu.org

Global Credit Union

P.O. Box 196613

Anchorage, AK 99519-6613

Find a branch or ATM

We are where you need us. Global provides branch locations throughout Alaska, Arizona, California, and Washington, and access to more than 55,000 surcharge free ATMs worldwide.

In a state with no Global branch locations? Access more than 5,600 Co-op shared branching locations to make a variety of financial transactions, including loan payments, withdrawals, deposits, and more.

Additional resources

Most frequently asked questions

The Routing or Transit number identifies Global Credit Union and is used in check processing. Global's Transit number is 325272021. This number is the first 9 digits listed on the bottom of your checks.

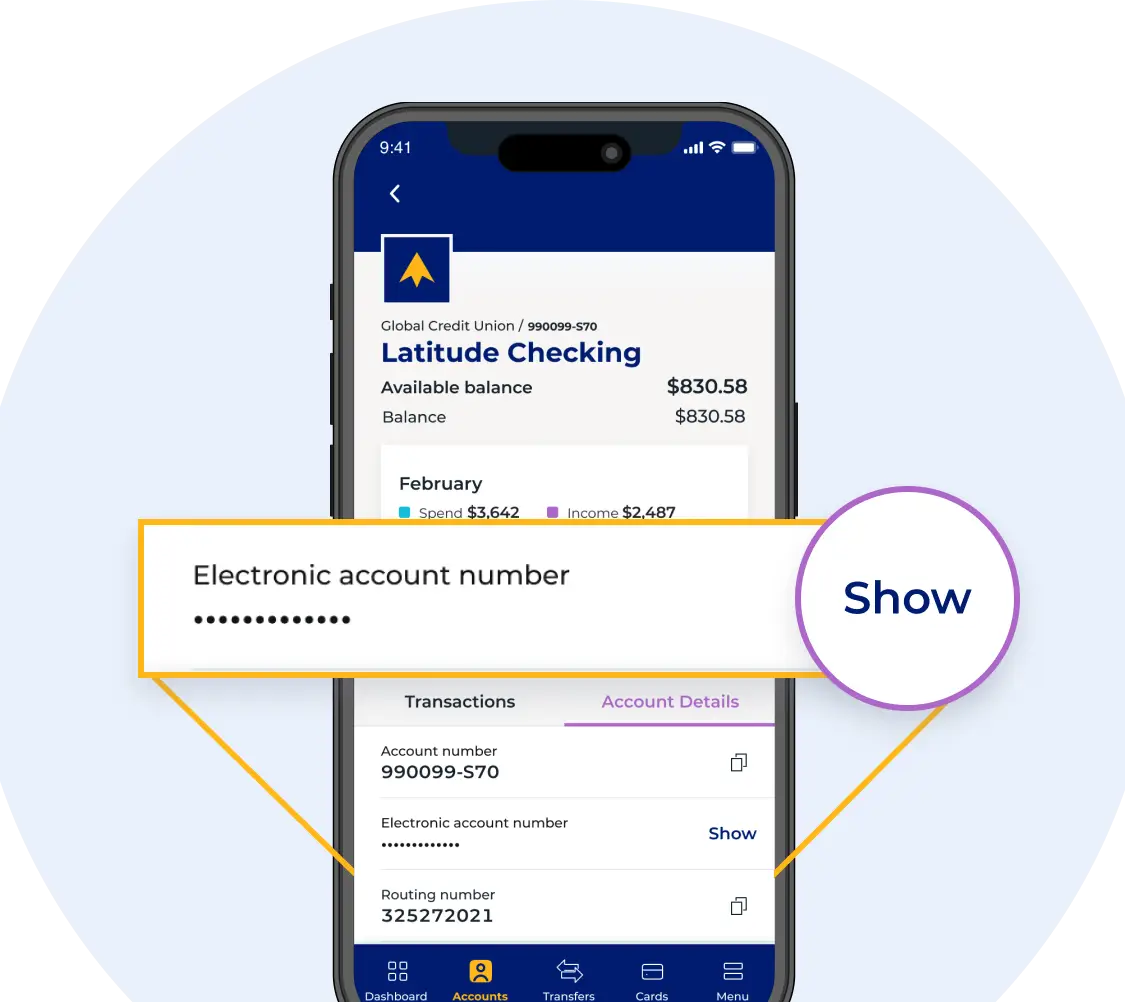

Your full account number for electronic deposits or payments can be also found in the Global CU app. To view your full account number: open the Global CU app, select a Global account, tap on 'Account Details', then tap 'Show' next to Electronic account number.

To report a lost or stolen card contact the Member Service Center at 800-525-9094. You can also lock your card from further use using the Global app or by accessing your account online.

If you believe there is an error with a transaction on your account, contact the Member Service Center at 800-525-9094.

Additional information regarding electronic transactions

Federal Regulations provide certain protections and limitations for specific types of electronic transactions, including:

- Point of Sale (POS)

- Automated Teller Machine (ATM)

- Direct Deposit

- Preauthorized Payment

- Online Account Access

- Electronic Check Transactions

Learn about your rights, responsibilities, and protections associated with these electronic transactions in the Electronic Funds Transfer Disclosure provided when you applied for Direct Deposit, Online Account Access, or a Visa® Debit Card.

You can start a credit report dispute online.

In most cases, we can make a decision on your loan application in under 24 hours. You will receive an email at the address you used in your application notifying you of the decision or you can check your application status online.

Call 877-747-5073 with any questions about your current Global Credit Union Home Loan, or contact the Member Service Center to be directed to the appropriate person to answer your question.

Corporate offices

Global Credit Union

P.O. Box 196613

Anchorage, AK 99519-6613

Deposits / Payments (Alaska)

Global Credit Union

P.O. Box 196613

Anchorage, AK 99519-6613

Deposits / Payments (U.S. and international)

Global Credit Union

PO Box 12705

Glendale, AZ 85318-2705

Express deliveries

Global Credit Union

4000 Credit Union Drive

Anchorage, AK 99503

We welcome your feedback. Submit your comments online using our feedback form.

Knowledge is power

Equip yourself to make smart financial decisions in every stage of life—subscribe for financial know-how and more.