Business savings accounts

Put your money to work

Earn dividends with as little as $501—no maintenance fee or minimum balance required.

A steady rate of return

Our Business Savings account offers a secure, reliable way to meet your financial goals.

Savings account features

Convenient Access

Use any of the 55,000+ surcharge free ATMs in your network. If you also have a Global checking account, you can use your Visa® Debit Card for both your checking and savings accounts.

Overdraft protection

Sometimes your business needs the flexibility to go over balance—that’s where overdraft protection3 comes in. Ask for overdraft protection to take funds from your Business Savings, Business Money Market, or credit line.

If you need to use your overdraft protection, there is one low fee charged the next day—rather than for each individual transaction.

Even more benefits

Use your Business Savings account to secure a pledge of shares loan to get the working capital your business needs.

Automate your saving by setting up automatic deposits from another account.

Talk to a real person through the 24/7 Member Service Center—even on holidays.

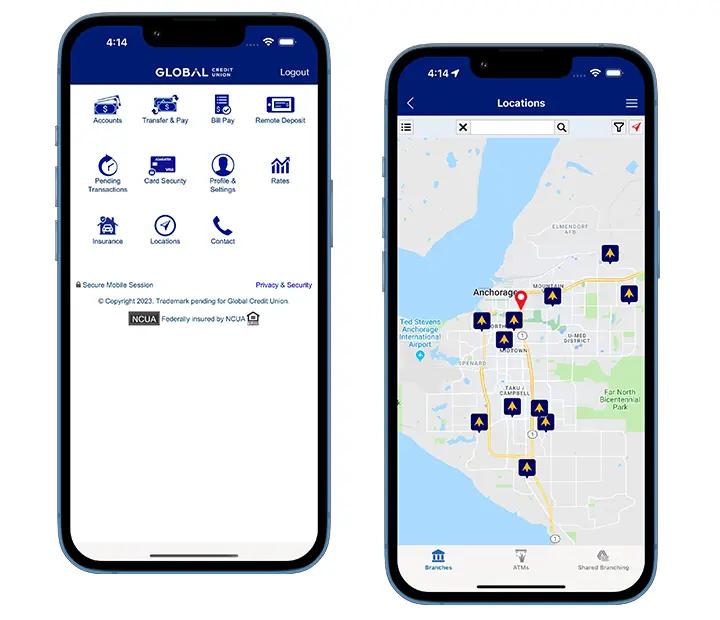

Online & Mobile Banking for businesses

Our mobile app and online banking for businesses are secure, and convenient.

- Review your finances with quick and easy reports that you can customize.

- View your transaction details and account balances.

- Give other users access to specific features.

- Transfer money between your accounts.

- Make deposits remotely, electronically or by mail.

- Pay bills and make ACH and wire transfers1.

Savings Account FAQs

There’s no maintenance fee for a Business Savings account.

We calculate dividends daily and credit them to your account every quarter. You earn dividends on your savings from the date of deposit to the date of withdrawal. You must have a minimum balance of $50 to earn dividends2.

No, there’s no limit to the number of withdrawals you can make. To access your account, you can:

- Use any of the 55,000+ surcharge free ATMs in our network.

- Transfer money through online & mobile banking.

- Visit one of our Global branches or one of the many locations in the CO-OP Shared Branch Network®.

Yes, your Global accounts are federally insured up to $250,000 by the NCUA, an agency of the U.S. government. This includes accounts for individuals, businesses, organizations, associations, and public units.

Learn about money management

Always here when you need us.

Our business professionals are here to help. Get in touch with a member of our team for a complimentary, no-obligation consultation.

1The applicable minimum daily balance is required to obtain the stated Annual Percentage Yield (APY).

2Minimum balance of $50 must be maintained throughout the quarter to earn dividends.

3A Business checking account is required to sign up for overdraft protection.

4Additional fees apply. See the Business fees page for more details.

For complete account information, refer to the Share Account Disclosure Statement. You will also receive one at the time an account is opened.