Business checking accounts

Checking for businesses of all sizes

Earn dividends and eliminate your monthly fee when your balance is more than $1,000

Business checking made easy

Your everyday business banking is easy and convenient with a Global Business Checking Account.

- Earn dividends when you maintain a minimum balance of $1,000 throughout the calendar month

- No monthly maintenance fee unless your balance falls below $1,000 during the calendar month

- No activity fees for your first 100 checks deposited or paid

- No fee to transfer money between your Global accounts or stop a payment

Business checking account features

Easy access and top security

With your Business Visa Debit Card, you have 24/7 access to your account—and you can use your card anywhere that accepts Visa Debit Cards.

Your Business Visa Debit Card includes built-in security features:

- Visa's Zero Liability Policy protects you from unauthorized charges if your card is lost or stolen.

- Easily turn on or off your debit card with the Global App.

- Your debit card has a 3-digit security code you can use to verify your identity when you’re shopping online or by phone.

Overdraft protection

Bouncing a check can be awkward and expensive. When you set up overdraft protection for your business checking account from your Global Credit Union business savings account, business money market account, or business line of credit, you can avoid all that. If you need to use your overdraft protection, there’s a small fee*, and you’ll get a notice so you can keep your records straight.

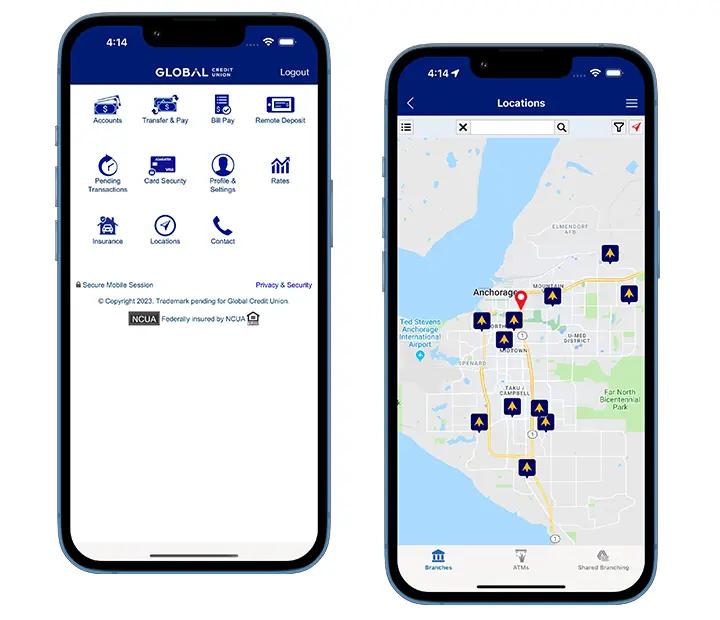

Online & Mobile Banking for businesses

Our mobile app and online banking for businesses are secure, and convenient.

- Review your finances with quick and easy reports that you can customize.

- View your transaction details and account balances.

- Give other users access to specific features.

- Transfer money between your accounts.

- Make deposits remotely, electronically or by mail.

- Pay bills and make ACH and wire transfers1.

Business Checking Account FAQs

Yes, all Global checking accounts are federally insured up to $250,000 by the NCUA, an agency of the U.S. government. This includes accounts for individuals, businesses, organizations, associations, and public units

Dividends for business checking accounts are calculated daily and paid monthly. You must maintain a minimum balance of $1,000 throughout the month to earn dividends.

Yes, you can authorize access to online banking for employees, accountants, and other trusted individuals. You can also customize their level of access, so they’re only able to use the accounts and capabilities they need.

Please see the Business, Organization, Association, and Public Unit Share Account Disclosure Statement (with Business Schedule of Service Fees) for full account details.

Learn about money management

Always here when you need us.

Our business professionals are here to help. Get in touch with a member of our team for a complimentary, no-obligation consultation.

*$5 per day for Business Savings or Money Market or $5 per transfer in excess of 3 per calendar month.

1Additional fees apply. See the Business, Organization, Association, and Public Unit Share Account Disclosure Statement (with Business Schedule of Service Fees) for more details.