Frequently Asked Questions

Listed below are some of the most frequent account-related questions we get from members.

Account FAQs

You can change your address by visiting any branch, or by calling the Member Service Center 24/7 at 800-525-9094.

The Routing or Transit number identifies Global Credit Union and is used in check processing. Global's Transit number is 325272021. This number is the first 9 digits listed on the bottom of your checks.

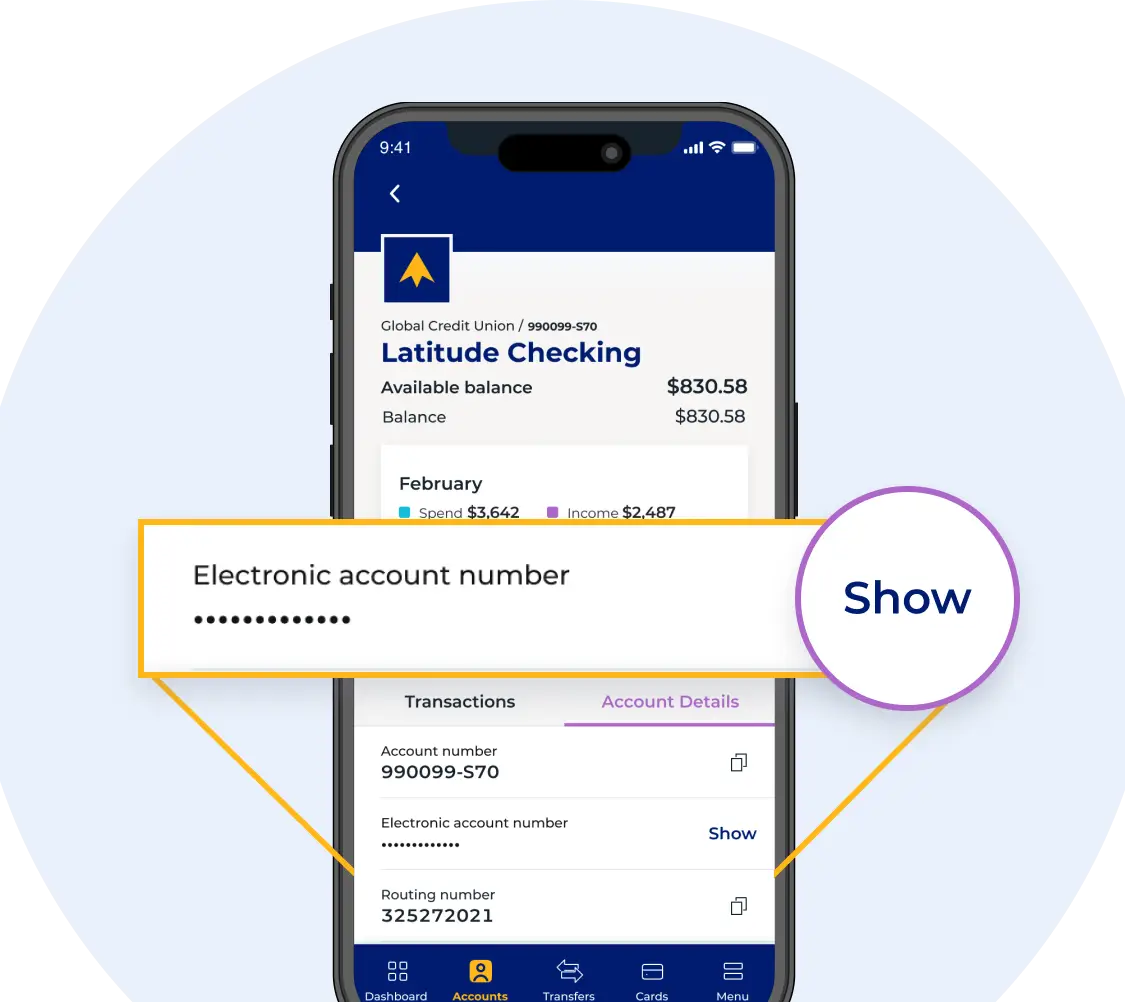

Your full account number for electronic deposits or payments can be also found in the Global CU app. To view your full account number: open the Global CU app, select a Global account, tap on 'Account Details', then tap 'Show' next to Electronic account number.

Yes! Members using online account access may elect to receive eStatements, electronic versions of their statements, instead of paper statements in the mail.

How to sign up for eStatements:

- Log in to your account and Click on the "Account Services" tab

- Near the bottom of the page, click on "Receive eStatements only"

- Review and accept the "Electronic Statements and Notices Disclosure Agreement".

If you wish to receive an email reminder when your new eStatement is ready, enter your email address where indicated.

By signing up for eStatements, you are agreeing to receive your statement and important disclosure and regulatory information electronically. Some communications may still be delivered via the mail as required.

From another Global member:

Global members can transfer funds to you using online account access. All they need is your last name, account number, and account type.

From non-members and businesses:

An individual or business can initiate payments to you by visiting their financial institution. They will need Global's routing number and your electronic account number, which can be found in the Global CU app or on a Global check. For more information visit globalcu.org/support/ach-number/.

An ACH transaction is an electronic transfer of funds. Some examples include: direct deposit of payroll (including military pay), government benefits, tax refunds or payments, Alaska Permanent Fund Dividend, payments to utility bills, and many others.

Members can view a pending ACH transaction as soon as Global receives the transaction instructions, which can often occur the day before the actual transfer. To view a pending ACH in online, log in to your account and Click on the “Pending ACH” link below the tabs. View your pending ACH transactions at the bottom of the page. In the Global app, simply click on the 'Pending Transaction' icon.

To report a lost or stolen card contact the Member Service Center at 800-525-9094. You can also lock your card from further use using the Global app or by accessing your account online.

You can access Card Security online or with the Global app. Simply open the Global app and click the Card Security icon, or log in to your account online and click the Card Security link.

Once you have accessed the Card Security page on the app or online, simply click the on/off button to turn your card on or off.

- Report lost checks/identification: Call the Member Service Center at 800-525-9094

- Report lost traveler's checks: Call 800-525-7641

- Report lost money orders: Call 800-654-5920

You can order checks online, by calling the Member Service Center, or by visiting any branch location.

If your address has changed, please change your address prior to ordering checks.

If you need to submit a change of name to the credit union, please contact the Member Service Center or visit a branch.

How to order checks online

To place an order within account online, select "Order Checks" under the Account Services tab and follow the instructions.

You can place a stop payment on a lost or stolen check that has not yet been presented for payment by online, at any branch, or by calling the Member Service Center 24/7 at 800-525-9094.

To place a stop payment online, log in to your account and click on the "Account Services" tab. Choose ""Stop Pay"" from the list of available options. You will be asked for the check number and amount.

Your new ATM or Visa® Debit Card must be activated before use. You can activate your card in several ways:

Activate your ATM or debit card

Activate online

- Log in to your account

- Click on the Account Services tab

- Select the Activate Card link

- Enter your card number and click Submit Activation Request

Activate by phone

Call 866-281-6296 and follow the instructions

Call the Member Service Center

- Call 800-525-9094 or 907-563-4567

- Have your card ready to verify with the member service representative.

Activate your Visa Credit Card

To activate your new or replacement Visa Credit Card call 800-543-5073.

No, members no longer need to contact us if they are going on vacation.

If your card is flagged for suspected fraudulent activity while you're traveling, you will receive a text message or email notification asking you to confirm or deny the transaction.

To ensure you receive notifications, update your contact information by calling us 24/7/365 at 800-525-9094.

If you believe there is an error with a transaction on your account, contact the Member Service Center at 800-525-9094.

Additional information regarding electronic transactions

Federal Regulations provide certain protections and limitations for specific types of electronic transactions, including:

- Point of Sale (POS)

- Automated Teller Machine (ATM)

- Direct Deposit

- Preauthorized Payment

- Online Account Access

- Electronic Check Transactions

Learn about your rights, responsibilities, and protections associated with these electronic transactions in the Electronic Funds Transfer Disclosure provided when you applied for Direct Deposit, Online Account Access, or a Visa® Debit Card.

You can distinguish accounts by giving them account names that are meaningful to you, like "Snowmobile loan" instead of "L10 Loan," or "Jenny’s college fund" in place of "S81 Certificate."

To create new names for your accounts log into your account and click on the pencil icon next to the account name on the "Account Summary" page.

We know that settling the financial affairs of a loved one can be overwhelming, so we created a guidebook to help with the process of settling Global accounts. You can also email our Legacy Support Specialists at LegacySupport@globalcu.org for assistance.

Account Settlement GuideMinor Account FAQs

Global considers anyone under the age of 18 to be a minor.

A parent/legal guardian must be present and provide the following documents for minors under the age of 16.

- Two (2) forms of ID

- The minor’s SSN

- The minor’s birth certificate OR Legal Guardianship documents

- Minors aged 16 and older must also:

- provide a government issued photo ID

- be present during the account opening

If the parent/legal guardians’ last name is different from the name on the birth certificate or Legal Guardianship documents, name change documents must also be provided.

Minors age 16 and up who are opening a Core Checking account must also have a parent/legal guardian present, but may open a savings account without their presence.

Minors aged 13 and older may be eligible to receive a debit or ATM card in their name. Minors 12 and under may be issued an ATM card in the name of the parent or guardian but cannot be issued a debit card.

Yes. The parent or legal guardian will have to sign the online banking agreement on the behalf of minors aged 15 and younger. The password will be provided to the parent or guardian.

Minors aged 16 and older will sign the online banking agreement and the password will be provided to them.

At the request of the parent or legal guardian, minors may be eligible for:

- Savings

- Core Checking (aged 13 and older)

- Certificate accounts

- Money market accounts

- Individual Retirement Accounts (IRA)

Minors are not eligible for overdraft protection services.

A parent/legal guardian must be a joint account owner for all minors under the age of 16, and for minors 16 and older opening a Core Checking account.

Yes, minors aged 15 and under can conduct deposits into their account. However, they are not authorized to perform withdrawals unless a joint owner is present. Exceptions may be approved by a Branch Manager or supervisor based on the circumstances.

Minors aged 16 and older are authorized to perform deposits and withdrawals.