A good credit score is a valuable financial asset. Not only can it save you money through lower interest on credit and loans, but it can also unlock access to more favorable loan terms, credit card perks, better job and housing options, and more.

To get the best credit score possible, it’s important to understand the factors that affect it.

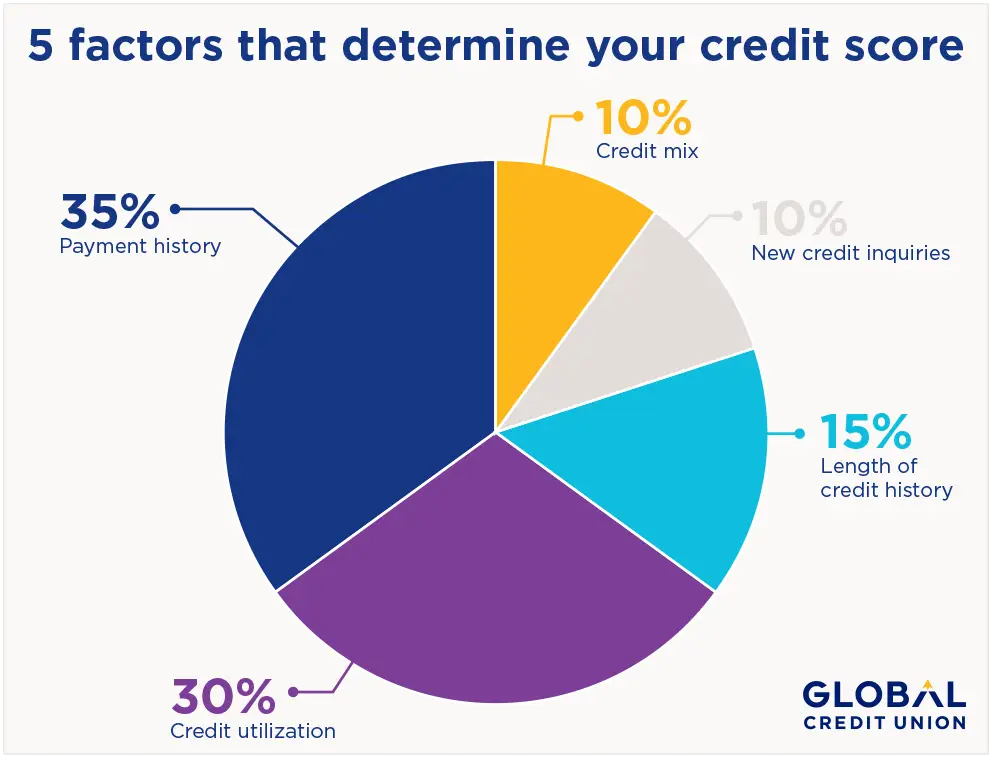

What factors affect your credit score?

The exact formulas used to determine your credit score are an industry secret, but overall, here are the factors considered by FICO®, a leading credit scoring company, and the relative importance of each.

Source: Your FICO Score, from FICO | myFICO

It’s important to understand what’s considered for each of these five factors, and to know what you can do to positively affect your credit score.

- Payment history: 35% Your credit score is a number that gives people an idea of how reliable you may be with credit, loans, and paying bills. Your payment history is the most important factor as it is an important predictor of how likely you'll pay future debts. It includes payment history for any credit cards, car loans, and mortgage(s). While a few late payments don’t automatically hurt your credit score, if you have a history of paying your bill more than 30 days past the due date, it can negatively impact your credit score for up to seven years.

While it seems simplistic, the best thing you can do to positively affect your credit score is to pay your bills on time. Sign up for eBills if possible, to avoid lost mail, automate your payments, or put an alert in your calendar to remind you of loan due dates. Ask your lender, medical provider, or landlord if they can shift their due dates to match the dates you get paid. And if you somehow miss a payment, do whatever you can to catch up immediately. - Credit utilization: 30% The amount of credit you’re using (owe), compared against the amount of credit you have available, will also affect your credit score. This percentage is called credit utilization. Most lenders want to see credit utilization below 30% and keeping it around this percentage will positively affect your credit score. For example, if you have two credit cards, each with a $12,000 credit limit, aim to carry the lowest balance possible, but certainly less than $7,200 total (2 x $12,000 x 0.3). If you’re using most of your available credit, it indicates that you may be overextended and living beyond your means. To optimize your credit score, work to reduce your credit card balances by increasing your payment or by making an extra payment each month.

- Length of credit history: 15% Experience matters. When you show that you can reliably manage your debts over time, you will improve your credit score. Even if you pay off a loan, the record of that account stays on your credit report for up to 10 years. To help improve your score, establish your credit record by applying for credit as soon as you can. If you’re just starting out, you can get a secured credit card, which works like a regular credit card but is backed by funds on deposit in your savings account. Or get someone to co-sign for a loan or unsecured credit card. Keep old credit accounts open unless they have an annual fee; this also helps improve your credit utilization percentage.

- Credit mix: 10% Showing that you can handle different types of loans, a factor known as credit mix, positively affects your credit score. Possessing credit cards, personal lines of credit, auto loans, a mortgage, student loans, and more, shows that you can responsibly manage accounts that have both a fixed payment each month (called an installment account) and a revolving account, where the amount paid each month varies. If you don't have or need a credit card but have already worked on other, more weighty factors and wish to further improve your credit score, you may want to consider opening a low-or-no-fee credit card that you leave unused or pay off each month, which will not only improve your credit mix but your utilization ratio as well

- New credit inquiries: 10% When you apply for several credit accounts in a short period, it sends a red flag that you could have financial problems and can negatively affect your credit score. Try to limit the number of times you apply for new credit to about once every six months to avoid this. Take the time to get preapproved for a loan, and if you’re shopping for a large loan, such as a mortgage, try to consolidate your inquiries to a week or two, which also helps limit the impact on your credit score. There is a difference between what’s called a ‘hard inquiry’ on your credit, which is from an actual credit application, and a ‘soft inquiry,’ which happens if you check your own credit report or shop around for a better loan or credit card rate. ‘Hard’ inquiries can lower your credit score by a few points.

Follow a balanced approach

The key to building a good credit score is understanding what factors affect the number itself. And while no one is perfect—most of us have missed a payment at one point—it’s helpful to know how to recover when something does go wrong. The best way to improve your credit score is to pay your bills on time, but the other, less weighty factors are also important, including credit utilization, credit mix, length of credit history, and new credit inquiries.