Zero-balance Checking

An easy way to spend and receive money

Automate your in-and-out cash flow

What is Zero-Balance Checking?

Zero-Balance Checking gives you an easy way to manage your deposits and disbursements. By linking Zero-Balance Checking to a master account where you make all your deposits, you can maintain a balanced spending account.

Unused funds are moved from Zero-Balance Checking back to the master account where they can earn interest.

Zero-Balance Checking Benefits

Easy cash management

A Zero-Balance Checking account automatically transfers funds to and from your master account to maintain a zero balance. Since you don’t have to manually manage multiple accounts, you can focus on other parts of your business.

Fewer fees

By continuously balancing the account, a Zero-Balance Checking account helps avoid overdraft fees. This can prevent costly errors and help you save money in the long run.

Better cash flow

A Zero-Balance Checking account ensures funds are available when you need them by automatically transferring money from the master account—so you won’t have to worry about making payroll on time or being able to purchase supplies when you need them.

Business checking account features

Easy access and top security

With your Business Visa Debit Card, you have 24/7 access to your account—and you can use your card anywhere that accepts Visa Debit Cards.

Your Business Visa Debit Card includes built-in security features:

- Visa's Zero Liability Policy protects you from unauthorized charges if your card is lost or stolen.

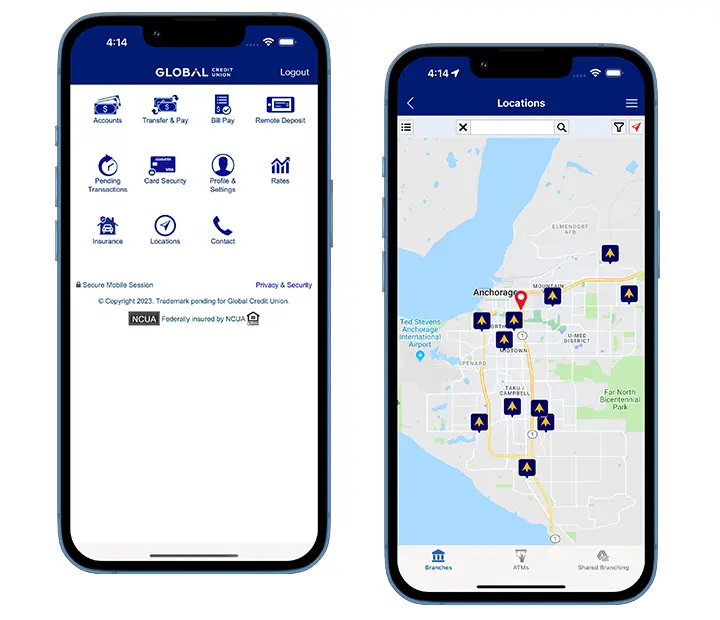

- Easily turn on or off your debit card with the Global App.

- Your debit card has a 3-digit security code you can use to verify your identity when you’re shopping online or by phone.

Online Business Banking

Choose the tools you need through Online Business Banking to manage all aspects of your business finances electronically.

- View your account balances and recent transactions.

- Transfer money between your accounts.

- Deposit checks with your mobile device.

- Make payments for your Global Visa® Credit Card and loan accounts.

- Pay other bills*.

Business Checking Account FAQs

Yes, all Global checking accounts are federally insured up to $250,000 by the NCUA, an agency of the U.S. government. This includes accounts for individuals, businesses, organizations, associations, and public units

Dividends for business checking accounts are calculated daily and paid monthly. You must maintain a minimum balance of $1,000 throughout the month to earn dividends.

Yes, you can authorize access to online banking for employees, accountants, and other trusted individuals. You can also customize their level of access, so they’re only able to use the accounts and capabilities they need.

Always here when you need us.

Our business professionals are here to help. Get in touch with a member of our team for a complimentary, no-obligation consultation.

Learn about money management

*$5 per day for Business Savings or Money Market or $5 per transfer in excess of 3 per calendar month.

1Additional fees apply. See the Business fees page for more details.