Frequently asked questions

Here are some frequently asked questions about what to expect as we move your accounts over.

Online & Mobile Banking

On November 1, 2025, you’ll get an email with instructions to enroll in Global Credit Union’s online banking and links to download our app.

Yes. At Global Credit Union your accounts are now managed on an account-based system. This means each account—personal, trust, or business—will have its own unique online banking login. You’ll need to enroll in online banking separately for each account typ

You’ll need to set up a new login for Global Credit Union’s online banking. We’ll send you simple instructions to get started on November 1.

Now through October 31, 2025, FFNW online banking is available, however any changes made in online banking after October 15, 2025, will not transfer to Global. This includes changes to:

- User IDs

- Scheduled or recurring transfer changes that go past October 31, 2025

- ACH and wire templates or participants

- Account additions/removals

- User permissions or profile updates

Yes, after November 1, 2025, our U.S. based call center employees are available 24/7/365 at 800-525-9094, even on holidays. We do not use third-party call centers.

On November 1, you will receive an email inviting you to enroll in online banking. As a part of that email there will be a link to the appropriate app for your account type.

In general, consumer accounts will use the Global CU app  .

.

The Global CU for Business app  will support the following account types.

will support the following account types.

- Business and commercial accounts

- Investor Custodian

- Representative Payee Account

- Irrevocable Trust Account

- Uniform Transfer to Minor Act (UTMA)

- Guardian / Conservator

- Estate

Cards & Payments

You can continue using your First Financial Northwest debit card through October 31, 2025. Starting November 1, you’ll need to use your new Global Credit Union debit card for all transactions.

Global Credit Union debit cards will start to arrive in the mail the week of October 6, 2025. You can activate it right away and start using it on November 1, 2025.

Your checks will keep working just like before—they’ll be automatically linked to your new Global account after November 1, 2025. There’s no need to order new checks; simply continue using your current ones.

Yes. Once your new card is active, update any automatic payments (like subscriptions or utility bills) to use your new card information.

No worries—your direct deposits and automatic withdrawals will keep working as usual. We’ll make sure everything is switched over for you.

FFNW Bill Pay and Zelle will be unavailable beginning October 27, 2025, however any scheduled payments from October 27 through October 31 will still be processed.

We will transfer all Bill Pay payees and any scheduled transfers to Global’s Bill Pay. Please log in and confirm that your payments are set up as expected after you’ve enrolled in online banking on November 1.

If your Zelle service is through First Financial Northwest, it will stop working on October 27, 2025. Zelle does not allow non-participating financial institutions like Global to use their service. We recommend using Global’s secure Bill Pay tool to send money. Other payment providers, such as Venmo, PayPal, or Cash app can also be used.

For your convenience, your Zelle token will be unenrolled from your account automatically.

Yes, Global supports Apple Pay, Google Pay, and Samsung Pay. You will need to link your new Global debit card to your existing wallet on or after November 1st.

Apple Pay is a registered trademark of Apple, Inc. Google Pay is a registered trademark of Google LLC. Samsung Pay is a registered trademark of Samsung Electronics Co., Ltd.

If you have UChoose Rewards points, make sure to use them before October 31, 2025, at https://ffnwb.com/uchoose. We’ll send you more information about any remaining points after November 1.

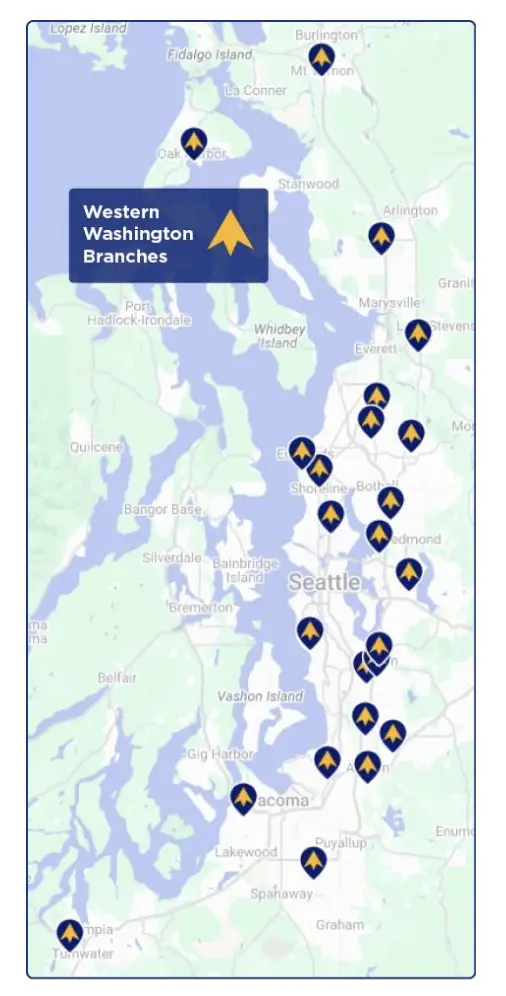

Branches, ATMs & Membership

You will have 24 conveniently located branches in the Western Washington area at your disposal starting November 3. You’ll also have access to branches in Eastern Washington, Alaska, California, Arizona, Idaho, and even on military bases in Italy. Plus, you will be able to locate over 55,000 surcharge-free ATMs nationwide, many in convenient locations such as Walgreens or CVS.

Visit our branch and ATM locator to search for ATMs near you.

As a Global member, you’ll have access to more loan options, credit cards, and business banking services. You can apply online or talk to a loan representative for personalized help.

As a Global member, you will have access to an expanded array of lending opportunities that include loans for autos, RVs, boats, and airplanes. For daily purchases or larger expenses we also offer credit cards, personal loans, and lines of credit. Additionally, we offer a large selection of home loan options to purchase or build a home, refinance an existing mortgage, or complete home renovations using home equity loans and lines of credit.

For our business members, we offer loans to purchase or refinance real estate, equipment, and vehicles, along with other secured and unsecured loan options and lines of credit to help your business grow. You can speak with one of our experienced loan representatives for a personalized loan application experience.

All our personal loan options can easily be applied for online, or you can speak with one of our experienced loan representatives.

People who live, work, worship, or attend school in Washington, Alaska, California’s San Bernardino County, Arizona’s Maricopa County, and Idaho’s Kootenai county can join Global. Membership is also available to anyone employed by the Department of Defense, anywhere in the world. Immediate family members of credit union members are also eligible to join.

Support & Security

You can call our 24/7/365 Member Service Center at 800-525-9094 or visit any Global Credit Union branch. We’re always happy to help!

To learn more about lobby and drive-thru hours at Global branch locations, please visit globalcu.org/branches.

The Member Service Center is also open 24/7/365 at 800-525-9094.

Yes! On Saturday, November 1, 2025, from 1:00 pm – 5:00 pm, former First Financial Northwest branches will be open for in-person help. You can also schedule a personal appointment for one-on-one support.

Yes. We take your privacy and security seriously, and your information will stay protected throughout this process.

Sometimes transactions take a few days to show up. If you have any questions or concerns, call us or visit a branch—we’re here to help.